The Newsroom SU News

The Newsroom is Seattle University’s central news site featuring the news and human interest stories that tell the Seattle University story through rich storytelling showcasing the distinctiveness of a Seattle University education.

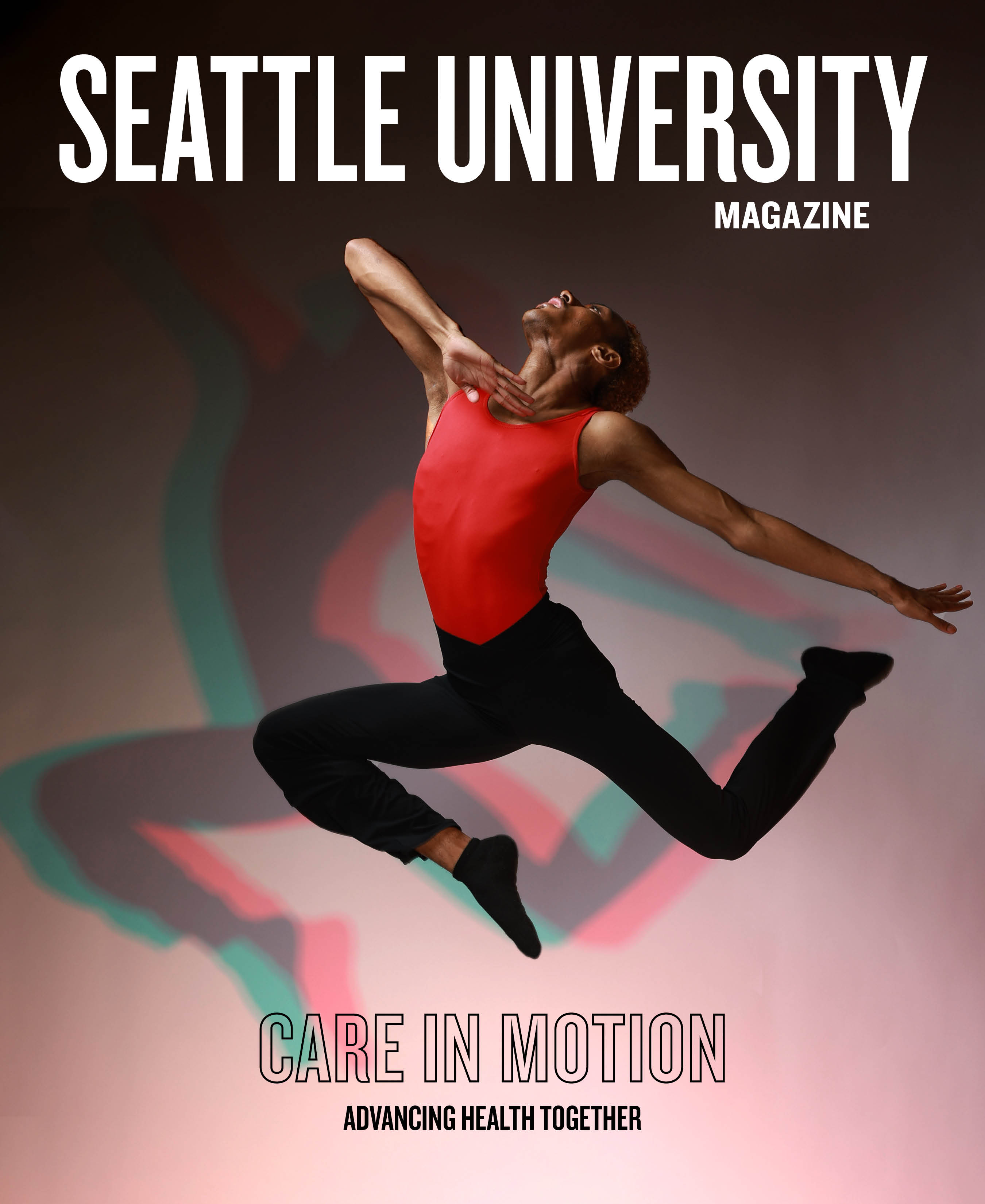

Seattle University Magazine

Featured Story

/113x0:2287x1600/prod01/channel_34/media/seattle-university/news-amp-stories/images/Erin-Martin-para-on-skis.jpeg)

Bright Horizon

Alumna is competing in Nordic skiing and biathlon at the Milano Cortina 2026 Winter Paralympic Games.

The Stories of Seattle University

Showing 6 articles of 625

Sculptural Art Blooms

The iconic Tulip sculpture created by Tom Wesselman now part of SU landscape.

/0x208:2400x1808/prod01/channel_34/media/seattle-university/news-amp-stories/images/Tulip-close-up.jpg)

A Super Month for SU in the News

The big game was, not surprisingly, a major source of news around these parts along with national issues with local implication.

/0x62:1744x1225/prod01/channel_34/media/seattle-university/news-amp-stories/images/SU-in-the-News-final-graphic.jpg)

/188x0:2213x1350/prod01/channel_34/media/seattle-university/news-amp-stories/images/Humanities-Day-graphic.jpg)

Commencement and Confetti

As the Seahawks soared to a Super Bowl victory, sociology grad Nijeria McClain balanced finals and football as she supported her beau, Devon Witherspoon.

/0x692:2400x2292/prod01/channel_34/media/seattle-university/news-amp-stories/images/Seahawks-Super-Bowl-photo.jpeg)

Grant Propels Women in STEM

College of Science and Engineering awarded $700k to support the development of experiential learning courses, expanding access and impact.

/0x0:2400x1600/prod01/channel_34/media/seattle-university/news-amp-stories/images/Enrollment_CSE_Classrooms_yk_035.jpg)

Resisting Hate, Finding Hope

Choirs will perform ‘Considering Matthew Shepard’ work that is a musical response to the young man’s death.

/210x0:1020x540/prod01/channel_34/media/seattle-university/news-amp-stories/images/Matt-Shephard-concert-final-art.jpeg)

Submit a Story Idea

Know an alum doing interesting, transformative work? A faculty member leading innovative research? An exceptional student or academic program that are change-makers? We want to hear about it.

/76x0:1924x1125/prod01/channel_34/media/seattle-university/directory/offices-amp-departments/images/departments/SpringCampusImagery25_hl_010-16X9.jpg)

/326x0:2075x1338/prod01/channel_34/media/seattle-university/images/aerials/SeattleUAerial_003.jpg)